80% of wastewater continues to be discharged untreated, adding to already problematic levels of water pollution, says Mirjam Wolfrum, Director, Policy Engagement, CDP Europe

What are CDP’s mission and activities?

CDP wants to see a thriving economy that works for people and planet in the long term. To achieve this, we focus investors, policymakers, companies, cities, states and regions on taking urgent action to build a truly sustainable economy.

CDP Europe is part of the global CDP non-profit network, which drives companies and governments to reduce their greenhouse gas emissions, safeguard water resources and protect forests. Globally, over 8.400 companies with over 50% of global market capitalization disclosed environmental data through CDP in 2019, including more than 2.100 European companies representing approximately 76% of the European market capitalization. This is in addition to the over 950 cities, states and regions globally who disclosed – including more than 215 in Europe – making CDP’s platform one of the richest sources of information globally on how companies and governments are driving environmental change.

The risks and opportunities of a water secure future must be embedded within business, financial markets, and policy decision making. Corporate transparency plays a vital role in driving the transition to a water secure future by encouraging a desire among key private sector actors and their supply chains to grow differently. As the market matures, CDP continues to raise the bar on corporate water performance, to support the systemic changes needed to decouple companies’ production and consumption from the depletion of water resources.

What do you consider as the key challenges of water risk management? How do you see companies dealing with water risks?

Water security represents one of the greatest challenges that businesses, investors, governments and citizens will face in the upcoming decades. We continue to manage water resources inefficiently across all sectors and some 80% of wastewater continues to be discharged untreated, adding to already problematic levels of water pollution.

The key actors necessary to achieve the EU Water goals are companies in the most impactful industries, such as food, energy, industrials, textile and materials. These industries including chemicals, pharmaceuticals and mining sectors account for and wield influence of the world’s freshwater use and pollution. The scale of dependence exposes the risks that these businesses will face in a world with greater water scarcity and degraded freshwater quality. A majority (62%) of companies from these sectors disclosing to the CDP water security questionnaire in 2019 stated that their business models are highly dependent on water availability and quality. 78% stated that the availability of good quality freshwater is important or vital to their direct business operations and 67% reported that the same is true indirectly in areas outside their operational control.

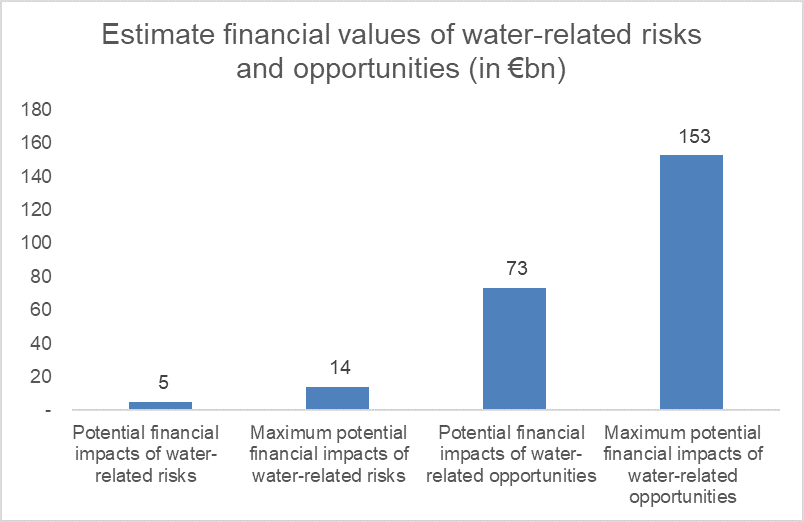

A high number (61%) of reporting companies identified water-related risks in their direct operations and/or in their value chain. The water-related risks reported by these companies have potential high financial impact and could occur in direct operations or the wider value chain, like physical impacts, particularly water scarcity or droughts and flooding.

Across 193 European businesses reporting to CDP on water last year, the total financial value at risk could reach up to €14 billion. A number of responding companies also reported difficulties in providing a standalone figure to quantify their water risk, suggesting that the true financial impact could be far higher.

However, out of the 193 companies disclosing, 74% reported water-related business opportunities, mainly in the area of water efficiency. The majority of respondents stated that they have a publicly available water policy setting out a clear position on water management. All responding companies have a water-related target and goal in place, most with targets at several levels. In total, over 340 targets were reported, over 100 of which were in water withdrawals and consumption. These targets and goals are largely aligned with the achievement of the UN´s SDG 6 on Clear Water and Sanitation. Some companies have also implemented internal water pricing mechanisms or water valuation practices.

Addressing more complex water risks and opportunities can pose a particular challenge, as issues frequently centre around an entire river basin relied upon by multiple governments, communities and businesses. The scope of action for individual actors can be limited. Involving all stakeholders provides multiple benefits for society and the planet: improving freshwater availability, taking pressure off groundwater reserves, and reducing pollution can benefit the health, wellbeing and wider economic success of local communities and ecosystems. Collaboration is key, and CDP is pleased to work with Water Europe to address these issues and provide necessary data in support of improved policymaking.

CDP recently published its A List for 2019, naming the world’s most pioneering companies leading on environmental transparency and performance. What have been the highlights and lessons learnt on water security from this year’s list?

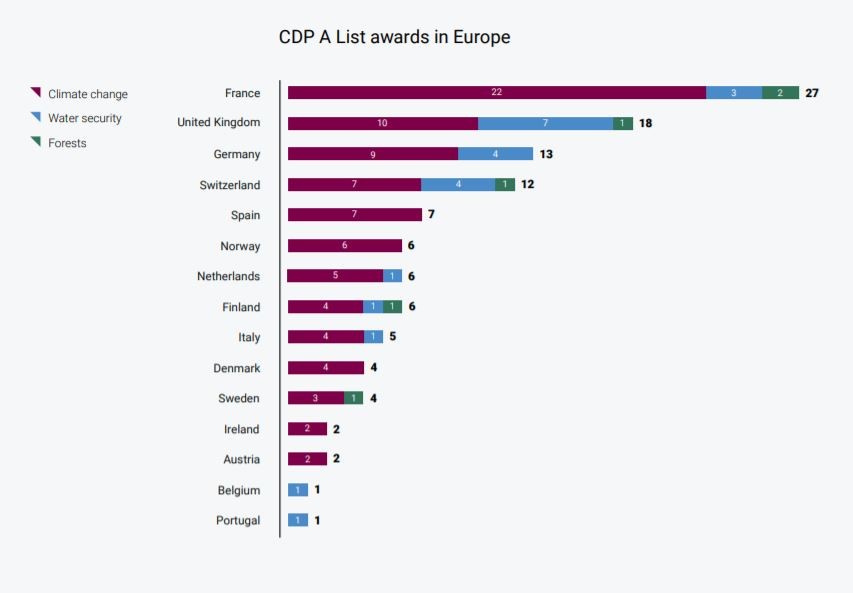

In 2019, there were 93 European corporates on CDP’s A Lists for climate change, water security and forests. Between them, 114 A scores were awarded: 85 A List awards for climate change, 23 for water security, and 6 for forests. On water security, the 23 European companies represent one third (32%) of the total awarded globally.

In recognition of the changes needed, CDP raised the bar for corporate leadership on water security in 2018. For a place on the water security A List, companies must now show that they regularly monitor and manage water aspects relevant to their activities through the whole value chain, that they have regular and comprehensive water risk assessment procedures that are grounded in the river basin, and a solid understanding of how water issues could impact their financial performance. At the same time, they should show that they have implemented a genuine strategic response to these risks, i.e. a company’s governance mechanisms and long-term business and financial strategies must be informed by and working to address water security issues.

While 23 European companies were able to meet these higher standards, the vast majority were not. However, more companies are taking actions and achieving higher scores. The increase in the number of responding companies – up from 183 to 193 in 2019 – and the growth in A scores from 11 to 23 last year is a visible sign of year-on-year progress.

Businesses report that they see a high financial value at risk due to water-related risks and that the cost of inaction could be significantly more expensive than the costs of action. Therefore, it is crucial for companies to integrate water strategies into their decision-making. Companies will not achieve the transformations needed until water is meaningfully embedded into corporate governance.

The European Commission published the European Green Deal a couple of months ago. What are your views about it and how do you think it can contribute to fostering green finance?

The new European Commission’s Green Deal sets out an ambitious agenda to place the EU on track for ‘climate neutrality’ by 2050. Key elements include legislation to bring the goal into law and ensure policy coherence with the target. The European Commission has estimated that overall investment in 2030 needs to be between €176 billion and €290 billion a year higher than it would be under current policies.

Recognizing this investment challenge, the EIB recently agreed to phase out financing for unabated fossil fuels and become the world’s first ‘climate bank’, and the Commission has proposed to dedicate at least 25 percent of the EU budget to climate as part of its European Green Deal Investment Plan, which aims to mobilize €1 trillion of investment over 10 years. Most of the low-carbon investment needed must come from the private sector, so the extent to which European companies’ low-carbon investment plans are compatible with this objective is a critical question. CDP’s reporting data shows how companies are responding to the low-carbon investment challenge and provides insights into the specific low-carbon initiatives into which they are investing. With this data, it is possible to estimate whether current corporate investment patterns are consistent with the net-zero goal.

The Green Deal also identifies the need for wide-ranging reforms to the European Taxation Directive and the taxation of international transport fuels, the Emissions Trading Scheme (ETS) and fossil fuel subsidies in order to ensure better carbon price signals. Policies and investment would be targeted at the circular economy and low-carbon transport and energy infrastructure. A raft of accompanying reforms to help mobilize low-carbon finance and investment are also anticipated, as part of the EU’s Action Plan on Financing Sustainable Growth and the European Green Deal Investment Plan.

The ways in which businesses affect freshwater resources is enabled by banks and institutional investors. In the absence of effective global corporate governance, commercial banks and their institutional investors can offer unique incentives for change by ensuring their investment and lending practices drive improvements in water security. European banks hold an amount of €42.89 trillion of total assets, which can be leveraged to drive water stewardship in companies’ business models by integrating water security in lending criteria. According to a recent CDP survey, global investor awareness of these issues is low. Only 22% of the responding financial institutions consider water security as an important issue for their institution. However, their investee companies are seeing major risks. It means that banks and other investors often fail to undertake adequate due diligence on their lending as it relates to water security.

CDP’s simple theory of change is that the disclosure of quality data leads to smarter decisions and informs investors, companies and governments of the actions they need to take. The process of annual disclosure brings new insights to markets and policymakers, based on data that never existed before. And it allows the companies and the financial markets to innovate in the way that they must meet the climate challenge, It is transparency about these corporate strategies that helps investors to drive capital towards the businesses with serious plans, who are investing in and leading the transition to business models which are low carbon, and not reliant on unsustainable water use. It is CDP that ensures this data is made comparable and delivered to global markets.